Hiro revamps home insurance for smart home owners

Getting a new insurance quote every year can be a true pain, with lots of questions to answer on top of having to sign up for a yearly policy. Hiro aims to make things simpler, with a rolling monthly contract that you can cancel at any time and discounts for any smart home products you have.

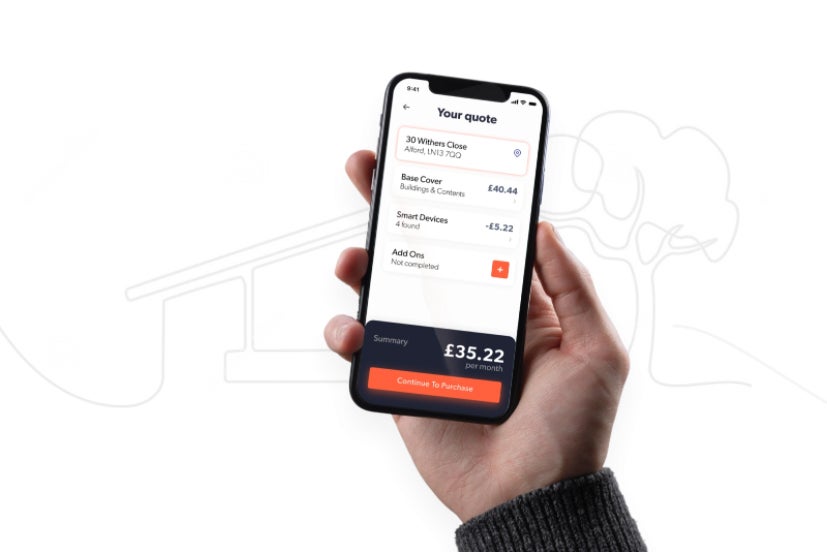

Although you can get a basic quote through the website, the Hiro app (Android and iOS) makes things easier.

First, the app automatically pulls in information about your home, including how many bedrooms you have, when it was built, what kind of roof you have and how much it would cost to rebuild.

Next, it can scan your network for recognised smart devices, a service that is in beta. Testing it on my home network, Hiro found my Lightwave RF bridge but nothing else: router capabilities have a part to play. However, I could manually add the devices that I have from the provided list of manufacturers and devices.

Why a discount for smart home device owners?

“Those who invest in smart technology are less risk,” says Krystian Zajac, CEO and co-founder of Hiro. “It shows that you care about your home more.”

You get discounts for a range of smart devices, including Sonos or Amazon Echo speakers; smart security, including the Ring Alarm; and smart lighting, such as Philips Hue.

You’ll get a bigger discount if you’ve got a water leak sensor in your home (water is one of the biggest causes of payouts for insurance claims): my Geo Waterlock system got me a big discount, with an overall quote lower than my current insurance.

Future plans

Currently, if you manually add devices, Hiro allows you to self certify, although you may need to prove that you own this kit for a claim. In future, the company plans to automate things by linking to your smart accounts, and detecting what kit you’ve got and even applying a discount if you add new devices.

“In future, we’ll link to your accounts,” explains Zajac. “You’ll get rewarded automatically when devices are added.”

Currently, Hiro is only for house owners, offering both building and contents insurance. Soon, contents-only insurance will be offered to suit flat owners, too. Plans are afoot to cover landlords via Airbnb, too.

“The Next big product for us is an Airbnb add-on,” says Zajac. “We can integrate with Airbnb’s API and cover you only when someone is in the house.”

Availability

Hiro is available now for UK customers, with free quotes via the app. The service is underwritten by the French insurance company Wakam.