Will Apple Become A Trillion Dollar Company?

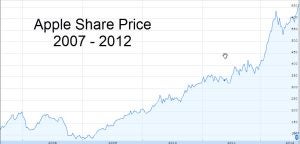

On Monday Apple became the most valuable publicly traded company in history. Stocks ended the day up 2.63 percent, roughly $665.15 a share, giving it a market capitalization of $623.52 billion (£393.61bn). With record financials and a new line-up of products on the way for Christmas the question must be asked: can anything stop Apple becoming the first trillion dollar company?

On Monday Apple became the most valuable publicly traded company in history. Stocks ended the day up 2.63 percent, roughly $665.15 a share, giving it a market capitalization of $623.52 billion (£393.61bn). With record financials and a new line-up of products on the way for Christmas the question must be asked: can anything stop Apple becoming the first trillion dollar company?

To fully grasp the current situation it is important to first put Apple’s valuation into context. The record Apple broke was that of Microsoft which was valued at $616.34 billion in 1999. Adjust for inflation and today that would be the equivalent to $850-900bn leaving Apple well short. Conduct a history lesson and the gap gets even bigger. In 1720 the South Sea Company hit a dizzying peak value of £3.675bn, equivalent to $73.8 trillion today.

But whether Apple is really number one over the course of history is not the issue – what happened to both its rivals is. Microsoft is today valued at $257.71 billion, a huge reduction (particularly allowing for inflation), while the South Sea Bubble was named after the South Sea Company’s spectacular collapse by 1721. While they fell away for very different reasons (fraud was central to the latter) key to initial concerns was the feeling that both companies had peaked and could only go backwards. With Apple currently worth $200bn more than the world’s second most valuable company, ExxonMobil, similar misgivings would be understandable.

The Case For

And yet Apple makes a remarkable case, not only for being worth its huge price tag, but potentially far more. “It is actually not amazing that Apple is worth $623 billion,” argues Henry Blodget of Business Insider. He points out that stock is trading at 13x earnings, which is widely considered a sensible sum. Furthermore “Apple is delivering on earnings in all major product lines, including the iPhone, iPad and to a lesser extent the Macbook.”

This is potentially just the start. With the iPhone 5 widely expected to be the first major reinvention of the handset since its debut in 2007 FBR Capital analyst Craig Berge is predicting Apple will sell 250 million iPhone 5 units over the device’s lifespan. To date Apple says it has sold 365m iOS devices worldwide. The jump isn’t deemed entirely down to the wow factor of the new phone of course, more that Apple has finally inked a deal with China Mobile – China’s largest operator – which boasts an incredible 683m subscribers.

Add on top of this the potential an affordable iPad Mini and the claims by former Apple CEO John Sculley that the TV market is Apple’s “game to lose” (a point I made last year) and it seems the Cupertino giant isn’t only expected to keep excelling in its existing markets, but to also start doing so in significant new ones.