What is Paym? A guide to the new mobile payment service

What is Paym?

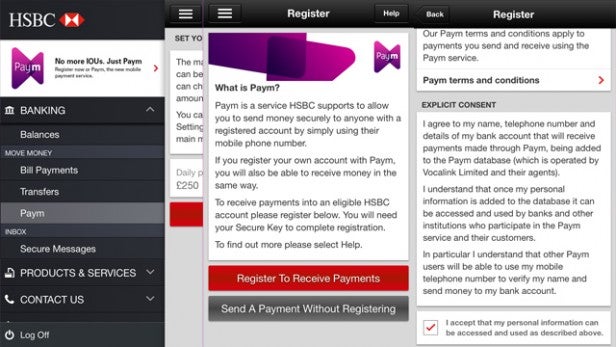

Paym is a brand new mobile payment system that lets you transfer money using just a mobile number. It lets you send money securely to anyone with a registered Paym account.

No longer will you need to badger your friends and family for their bank account details or make them go to cashpoint, as all you’ll need is their contact details that you’ll no doubt already have.

It also means you can keep your bank account details private, which is always good.

How does it work?

Once you’ve registered your mobile number with the current account you want to use, you’ll be able to send and receive payments with your mobile number.

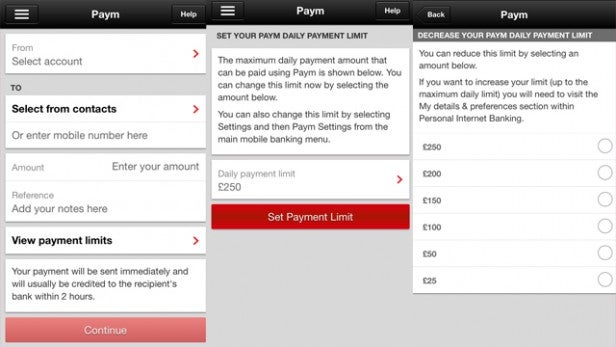

Within your mobile banking app on your Android or iOS device, you enter your Paym pal’s number using your contacts or manually put in the digits.

You’ll then be asked to confirm the recipient to make sure you’re not sending it to the wrong person, check the amount you want to send and then off it goes.

Your bank will send you a payment confirmation by text and then the money will appear in your contact’s account within two hours.

Who is involved?

You’ll need your bank or building society to sign up to Paym before you can use the mobile payment service.

Currently there are nine banking services signed up to Paym: Bank of Scotland, Barclays, Cumberland Building Society, Danske Bank, Halifax, HSBC, Lloyds Bank, Santander and TSB.

However, there are other banks and building societies that have already pledged to join the Paym service this year. These are as follows:

- Clydesdale Bank

- First Direct

- Isle of Man Bank

- NatWest

- RBS International trading as NatWest

- The Royal Bank of Scotland

- Ulster Bank

- Yorkshire Bank

Nationwide Building Society won’t be signed up to the service until early 2015 and Metro Bank is still finalising its plans, with no date just yet.

From this list, Paym claims that 90 per cent of current accounts will be compatible with the new service.

How do I get started?

You’ll need to register your mobile number to the current account you want to use with Paym before you can start swapping dosh with your friends and family.

It’s fairly quick and easy to do, but you’ll need to have online banking set up and your bank’s app installed on your mobile. Within your mobile banking app, just follow the prompts, accept the T&Cs and you’re off.

From then on, you’ll be able to transfer and receive money with others holding a Paym registered account as well.

To get to your bank specific instructions, head to Paym’s Who’s Involved web page.

How much does it cost?

The Paym service is currently free as banks and building societies are eager to get customers on board with the brand new mobile payment system.

That doesn’t mean it will be free forever though, but we expect you’ll be notified if anyone starts charging for the transactions made using the service.

What are the payment limits?

You can transfer up to £250 per day, but you can customise your daily limit within your banking app from anywhere between £25 and the maximum £250.

Is it safe?

The short answer is, yes. As Paym uses your existing mobile banking or payment app, which is already secure.

Paym itself states that “the service has been developed by participating UK banks and building societies to meet with their high security levels”.

All your bank account information is held securely within the mobile banking app, fully protected by data protection laws. The only information stored is the phone number you’re using to send and receive the payment.

What if my phone gets stolen?

You won’t be able to access the Paym service without your bank app passwords and security codes, but we advise you contact your bank immediately if your phone gets pinched or lost in any way.

Your bank or building society can then suspend the service until you can change your passwords and other security settings.

Legal protection when using Paym is just the same as with your other banking services, so you’re covered.

Can I use it to pay for other services?

Payments are currently limited to those made between individuals. However, there could be changes to come in the future.

Will it work with multiple bank accounts?

To keep it simple and hassle-free, you can only link one current account to your mobile number at present.

However, if you have a joint account you can register more than one mobile number to it, but you might want to contact your bank or building society for a little more information first.

Can I send money to my friends abroad?

Paym is limited to individual transactions made in the UK. If you need to send money to contacts in other countries, you’ll need to get in touch with your bank.

Read more: Best mobile phones 2014