Can Apple Pay really replace your wallet?

Apple Pay is tipped to launch in the UK on July 14. It’s actually been up and running in the United States since October last year, at thousands of locations. We sent our U.S. reporter out on a mission to use Apple Pay whenever it cropped up in his everyday routine.

Since it launched in the US, I’d used Apple Pay maybe 10-15 times. I’d not really made any big effort to use it instead of any other payment method. Until now.

However, the idea for this week was to stay within my usual habits and not to go out of my way to find places that would actually take Apple Pay. So, for example, I didn’t go to Sports Authority because I don’t need new trainers and I didn’t eat at Subway because I value my intestines. Likewise, I didn’t opt to shop at Winn-Dixie just because it offers Apple Pay and my supermarket doesn’t.

This was about simply making sure I used Apple Pay where and when I could, to see just how much it could become integral to my life.

So, without further ado, here’s my Apple Pay diary…

Monday

I spend a decent chunk of my time sitting in the cafe at Whole Foods. I can work there, the coffee is good, the food is nice, it has a bar and it’s close to my house/gym. Whole Foods has almost exclusively been the place I’ve used Apple Pay since it launched, so I kicked the week off there. The experience is fine and the hip, young staff don’t act surprised when you whip it out. The phone, I mean.

However, it’s strange that even after authenticating the payment with Touch ID, I still had to enter my debit card’s PIN at the terminal. Even for a small purchase like a six-pack of beer. I’ve seen people walk away with touch-and-go, but never me. Why not me?

I called my bank, Wells Fargo, to see if it was an added security measure. They said: “It ain’t us.” Whole Foods played dumb and there’s nothing in my Apple Pay settings that provides a hint either.

SEE ALSO: Apple Pay in the UK: All you need to know

Whatever it is, this weird little anomaly seriously undermines the convenience of using Apple Pay. Given that it sometimes takes a couple of attempts to be precise with my fingerprint, I might as well swipe my card, right?

There’s also a natural instinct to move the phone towards me to use Touch ID, but that breaks the connection with the reader. That’s led to repeated attempts too.

Anyway, you get a little notification on your phone once the payment is complete, which is reassuring.

Tuesday

I didn’t use Apple Pay today. I spent the morning at my local coffee shop, which accepts Square payments via a debit or credit card. It’s an easy solution for businesses without the expense of setting up and buying regular credit card terminals. They also get a better deal on fees per transaction thanks to Square’s flat 2.75% rate.

I was chatting with the owner about it. He explained Square offered a huge advantage over other providers, who seek to lock businesses into long contracts, charge maintenance fees and force them to buy all of their equipment.

In the afternoon I called into my local supermarket chain, Publix, which is the largest in South Florida. They just got fancy new payment terminals, so surely they’re contactless-friendly? Nope.

A spokesperson for Publix told me the new terminals are to enable chip-and-PIN cards, which, believe it or not, are a new thing here.

Wednesday

I had to run a bunch of errands on Wednesday, so I figured Apple Pay might come in handy during at least a couple of them.

I started the morning at Starbucks. Here, as in the UK, the barista scanned my unique Starbucks app barcode, which I’d topped up via PayPal. It would actually be great to have Apple Pay as an option here so I wouldn’t have to top up the card every couple of weeks.

Next, I went to Target, one of the biggest retailers in the United States. I knew Target accepted Apple Pay within its mobile app, as it features so heavily in Apple’s marketing. I figured in-store availability was a given. No such luck.

I’ve since read Target is also focusing on rolling out chip-and-pin across all its stores before adopting Apple Pay. Last year Target fell victim to a massive credit card hack, so it’s no surprise that they’re prioritising physical card security over Apple Pay’s simplicity right now.

The US Post Office was my next port of call. No dice either. “We’re not that advanced,” the lady told me. No s**t. As it’s a federal organisation, I’m surprised they’re even hooked up to the mains.

Next up, I had to hit up my local homebrew store to grab some brewing yeast for an IPA I’m plotting. They use Square too, obviously.

Thursday

Surprise, surprise, there was no Apple Pay use today either. I went to the most hipster coffee shop in town, had a couple of Americanos and a half-warmed pastry. The $15 it cost me (including the tip) was taken care of via Square, which also encourages you to tip at least 15% on top of the price.

Apple says it’s easy for small businesses to jump on board with Apple Pay, but it seems there’s little need for them to seek a change at this point.

I patronised craft breweries, merchandise tents at concerts, the homebrew store, food trucks, coffee shops and cafes during the test week, and practically all of them used Square.

A simple dongle for an iPhone or a special case for the iPad allows anyone to take debit/credit part payments without the cost of buying different machines. The Square Register app also makes it easy for retailers to itemise products and keep track of inventory.

Square has a brand-new reader that accepts contactless payments (including Apple Pay) via NFC, but that won’t be out until the autumn. Perhaps when that happens all of these independent businesses will begin accepting Apple Pay too?

SEE ALSO: Apple Pay vs Samsung Pay

Friday

After spending the morning at my local coffee shop (and paying by Square), I went for a haircut. I held my phone up to the terminal just in case and, lo and behold, my debit card popped up on the screen and I was prompted to use Touch ID!

Only it didn’t go through. I guess it must have been a contactless-ready terminal. The receptionist who took my payment had no idea what was happening anyway.

My wife and I went to pick up pizza (regular debit payment) and beer (Square) for the evening’s festivities and then retired to a bar for a couple of hours (debit).

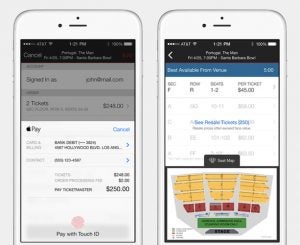

I have to admit, I missed a trick on Friday night. I ordered tickets from Ticketmaster on my laptop, but if I’d ordered through the app, I could’ve used Apple Pay to check out.

It just didn’t occur to me, but it’s a valuable part of this experiment. Almost every time I’ve used Apple Pay, I’ve gone for my wallet, before remembering I can use Apple Pay. When phone payment becomes automatic, then it will have really arrived.

Saturday

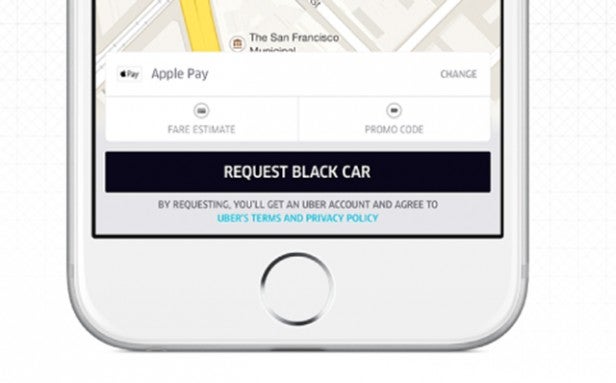

I actually got to use Apple Pay today. Not once, but twice! Unfortunately it was via the same company. We took an Uber cab to and from a wedding reception on Saturday evening.

Uber is one of the applications that features Apple Pay as a payment option within the app, which is handy. But is it really any different from paying via the Apple ID, which we’ve been able to do within apps for ages now?

The thing I liked about using it on this occasion is that I was a little worse for wear on the way home and I was easily able to check I hadn’t been fleeced the next day.

Sunday

We drove to Orlando for Warped Tour – the fabled day-long punk rock show that travels around the US every summer – and filled up the gas tank first thing in the morning.

The gas station didn’t accept Apple Pay either, but that’d certainly be one place I feel it would be useful. Texaco and Chevron are accepting it in stores, and planned to roll it out at the pumps in early 2015, but haven’t as yet.

Paying at the pump with Apple Pay, rather than messing around with cards and PINs would shorten an experience that’s unpleasant at best and downright scary at night, depending on your location.

That being said, is whipping a $600 iPhone out at a gas station any more appealing? Not really.

During the event, there were plenty of merch tables and food stalls accepting card payments via Square, but it was mostly a cash-only affair.

On the long drive home, there was one last opportunity to use Apple Pay. My wife pulled up at McDonalds to get some coffee for the road. We hit up the drive-through and I saw an Apple Pay logo in the window.

With hindsight, they probably would have held out a reader for me to hold my phone near, but my initial reaction was: “I don’t feel like handing over my phone to a McDonalds employee.”

I was probably being a little dramatic and snobby, but I don’t really want strangers, probably with burger-greased mitts, touching my personal possession.

Hold on to your wallets…

In total, I used my debit card 21 times during the week. Three of those transactions were with Apple Pay. That’s just over 14% of the time, so that’s not too bad I suppose. I could even have added one more (19%) had I thought about Ticketmaster in time, or two more if I hadn’t got cold feet at McDonalds (23%).

Six businesses took my card payments via Square and the rest were regular debit card payments, either in store or online. I also made a few cash payments on Sunday at the music festival, but that’s a real rarity these days.

After the experiment I think I’ll definitely be more aware of where I can and can’t use Apple Pay and will probably continue to make decent use of it. However, I’m not sure we’ll see fully ubiquitous ability to contactless pay using Apple Pay for quite a while.

Square rolling out its free NFC-friendly readers will help adoption among small businesses, but major retailers seem to be focusing on upgrading to chip-and-PIN right now.

It definitely seems like it’ll be one thing at a time at the moment. Quite frankly it’s mental that they’re only just starting to issue people with chip-and-PIN cards here, so I’d probably rather they get that down before I worry too much about using Apple Pay only 14% of the time.

Given that the UK’s a decade into using chip-and-PIN, perhaps British retailers will be able to focus more on the Apple Pay rollout than they currently seem to be in the US.