Cashing in: how to get the new Apple Card

Apple’s “It’s Show Time” event on March 26 was distinctly lacking in hardware reveals, but it did announce one typically minimalist physical object – a new credit card called the, uh, Apple Card.

An extension of its Apple Pay and Wallet services, the Apple Card runs on the Mastercard platform and is both a virtual and physical card that’ll work for both regular and Apple Pay transactions wherever Mastercard works.

But how does it differ from other credit cards and how can you get one? Here’s what we know so far.

What is the Apple Card?

The Apple Card will come in two forms – a virtual one that sits in your Wallet app, and a real titanium card that echoes the “subtle off-white colouring” business card scene from American Psycho.

The card itself looks cool but is fairly limited – it won’t support contactless payments, so you annoyingly won’t be able to just tap it on terminals for micro-payments. You will be able to do this with your iPhone, though, if you choose the Apple Card as your main card in the Wallet app.

Once you’ve signed up (see “How can you get the Apple Card?” below), Apple will send you the physical card for free with your name laser-etched on it. As you can see, there’s no card number, CVV code, expiry date or signature on the Apple Card. If you want to pay for something online using Apple Pay, though, these details will be on the virtual card in the Wallet app.

So what are the benefits of getting an Apple Card? For a start, there’s 2% cashback on anything you buy using Apple Pay, and 3% on any Apple products or services. Other purchases get 1% cashback. This is competitive rather than spectacular compared to other cards, and the 3% cashback for Apple products seems particularly miserly.

Still, there will apparently be no fees or penalty rates for using the Apple Card. This will include no late fees, no fees for international payments, annual fees or penalty interest rates.

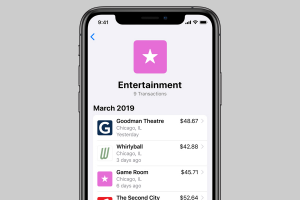

And as you’d expect for an Apple-branded product, there’ll be a focus on usability too – it apparently uses machine learning and Apple Maps to label your purchases with merchant names and locations, rather than confusing gobbledygook like ‘SHO No. 15’ for a Shell service station.

In a similar way to rival cards like Monzo and Revolut, your splurges will be automatically totalled and organized by color-coded categories like Food and Drinks, Shopping and Entertainment, with weekly and monthly spending summaries too.

How can you get the Apple Card?

The Apple Card will be open to applications in the US in Summer 2019. You can sign up to be notified of the exact date on the Apple Card page.

Unfortunately, there’s no news yet on an international release, though some industry commentators have speculated that it could arrive in the UK in autumn 2019. We’ll update this page as soon as we hear anything official.

The Apple Card won’t be open to everyone. Naturally, you’ll need to own an iPhone. And you’ll likely need to have some existing credit to qualify for one, though it’s not exactly clear what kind of credit score you’ll need.

Applying for an Apple Card (when it’s available) will just be a case of going into the Wallet app and drumming your fingers until you’re approved (or not). “It’s very cool, Bateman, but…”.

What do you think, will you be applying for an Apple Card when it becomes available in the UK? Let us know on Twitter @TrustedReviews.