Android Pay in the UK: Natwest and Santander are finally supported

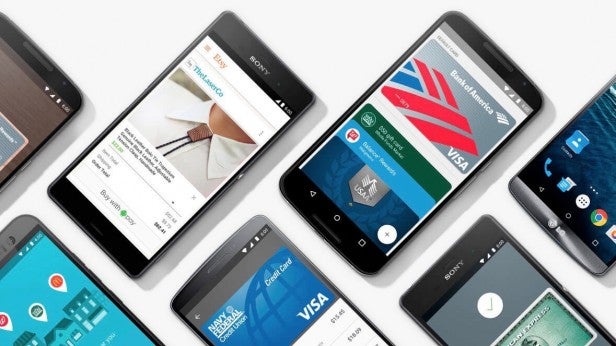

Android Pay has gone live in the UK and fans of wireless payments are rejoicing. But what exactly is it all about?

Android Pay has been up and running in the UK for a while now, but Google has just added a new slew of supported banks to the service. If you’re a Natwest, Santander, RBS or Ulster Bank customer you’ll now be able to ditch your wallet and pay via your phone.

Related: Android Pay vs Apple Pay: How do they compare?

WATCH: Android Pay UK hands-on: How does it work?

Which banks support Android Pay in the UK?

To use Android Pay, you’ll need to be with one of the supported banks. At launch, this included the Bank of Scotland, First Direct, Halifax, HSBC, Lloyds Bank, M&S Bank, MBNA and Nationwide Building Society.

In September Google added RBS, Natwest, Ulster bank and Santander.

The biggest missing name? Yep, Barclays. Barclays still doesn’t support Apple Pay and it doesn’t look like it’ll be getting in on the Android Pay action either.

What is Android Pay?

As the name suggests, Android Pay is the Google equivalent of Apple Pay. That is, a mobile payment system that allows you to use your smartphone to buy stuff.

Related: Will my phone work with Android Pay?

All you need to do is hold your compatible Android phone up close to the appropriate payment point in a shop and authenticate using your phone’s fingerprint sensor, passcode, or pattern, and the payment will be processed without so much as a glance at your wallet.

Android Pay essentially replaces the old Google Wallet in its ability to store and manage digital versions of all your cards, from simple store cards to full-on credit cards.

Indeed, Android Pay can combine these various accounts so that when you pay for something in a certain retailer, all the relevant reward points and offers will automatically be applied.

How Android Pay works in shops

A large number of Android phones contain NFC (Near Field Communication) technology. In fact, they’ve been packing such tech into Android phones long before Apple started doing so with the iPhone 6 and then iPhone 6S.

Related: Best Android phone

NFC enables your phone to initiate highly localised data transfers. These are initiated by physically tapping the phone to the relevant NFC point.

This is how Android Pay works in shops – hold your NFC-equipped phone up close to the payment point and authenticate your payment method when asked.

Google has confirmed that Android Pay will work wherever contactless payments are currently accepted; places like Boots, McDonalds, Pret and the London Underground included.

How do I set it up?

First, you’ll need to download the Android Pay app from the Google Play Store. We’re sure it’ll also come preinstalled on certain devices too.

You’ll then need to use this app to add your payment cards (either Visa of MasterCard). There’s a good chance you already have a payment method or two associated with your Google account, in which case this stage will be even easier.

Even if you don’t, Google has included one of those cool card-scanning tools that works by taking a picture of your card with your phone’s camera.

And that’s it; you’re ready to roll at all compatible retailers. You don’t actually need to manually start up the Android Pay app to use it – the aforementioned physical tap is all that’s necessary.

Which phones will Android Pay work with?

As we’ve mentioned already, Android Pay operates using NFC, so your phone needs to have such a component to operate.

Fortunately, if you’ve bought a fairly decent Android phone over the last few years, it will probably have NFC. At launch, Google estimated that Android Pay would be compatible with 70 percent of Android devices.

There are a couple of notable exceptions, such as the OnePlus 2, but any mid-range or high-end phone from major manufacturers like Samsung, LG, Motorola, and Sony should be compatible.

Android Pay also requires that you have Android 4.4 KitKat or above installed on your phone. Again, if you’ve bought a decent Android phone some time over the past few years, it’ll almost certainly meet this requirement.

Is Android Pay secure?

It certainly should be. Like Apple Pay, Android Pay doesn’t actually store your bank account details on your phone as such. Rather, it creates a virtual card that has access to your account, and each payment is an isolated transaction that doesn’t share any such information with the retailer.

Of course, Google doesn’t have the same tight leash on phone hardware as Apple does, so it can’t handle this tokenisation on a dedicated secure chip the way Apple can. Instead, the process happens in the cloud. If you can’t access the internet, your Android device will apparently store a limited number of tokens locally.

Additionally, if your Android phone is ever lost or stolen, you can use the Android Device Manager tool to remotely lock it. Alternatively you can wipe it off all your personal information.

Where can I use Android Pay?

Android Pay worked with around 700,000 retailers at launch in the US, which is roughly the same number as Apple Pay. In the UK, you can use Android Pay wherever you see the now ubiquitous contactless payment logo.

Indeed, it seems as if Google has directly benefited from Apple’s own pioneering mobile payment work in persuading retailers to join.

A glance at the retail support for Android Pay suggests as much, with major retailers like McDonalds, Coca Cola, Lego, Footlocker, Nike, and Disney Store all present.

Google’s experience with Google Wallet (which launched in 2011) also means that its online payment system is a little more advanced. The likes of Uber, Groupon, Domino’s, hotels.com, and Expedia all announced compatibility with Android Pay in the US at launch, enabling you to pay for services online (and through apps) quickly and securely.

In fact, Google has worked with app developers to include a ‘Buy with Android Pay’ button to apps.

With support for major credit and debit cards, and a wide range of devices supported, Android Pay is set for success in the UK. Shame about Barclays though.