Apple Pay in the UK: Lloyds Bank support coming soon

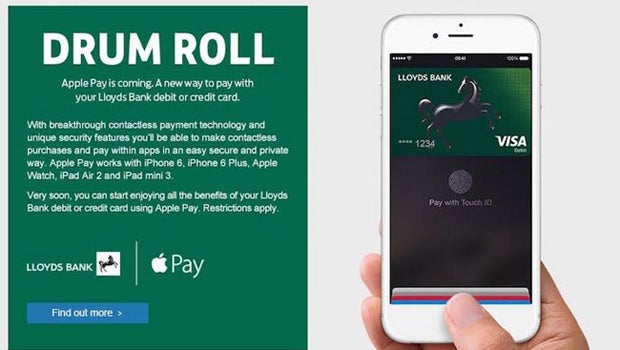

Lloyds Bank will join the ranks of major UK financial institutions to offer Apple Pay to their customers.

In an email sent out to customers on Friday (via MacRumors), the firm said support for the NFC-based wireless payments technology will come to Lloyds cardholders “very soon”.

As with other banks enabling Apple Pay, it’ll be open to debit and credit card holders, and purchases will be limited to less than £20.

Those already on board include HSBC/First Direct, MBNA, Nationwide, NatWest, the Royal Bank of Scotland, Santander and Ulster Bank.

SEE ALSO: Apple Pay in the UK – What is it and how does it work?

Apple Pay is Cupertino’s effort to own the mobile payments market. Users of the iPhone 6, iPhone 6 Plus Apple Watch, iPad mini 3 and iPad Air 2 can use it to make payments, authenticating them using the Touch ID fingerprint sensor.

It rolled out in the UK last month following a successful US launch in October 2014.

Have you used Apple Pay yet? Share your experiences so far in the comments section below.